NACM National Trade Credit Report (NTCR)

Domestic Credit Report Solutions

The NACM National Trade Credit Report (NTCR) is offered exclusively to NACM members, and has the extensive trade database that can give you the information needed to make informed credit decisions. The trade payment history comes from the members of 40 different NACM locations coast to coast.

These tradelines are submitted through monthly accounts receivable submissions and NACM Industry Credit Groups.

Each affiliate is identified in the report, with the tradelines from that affiliate location displaying under their name. The most recent tradeline per NACM member is displayed in the tradeline section and historical trade payments reported are graphically trended in the next section of the report, comparing two years of the customer’s payment history. From these trends, the NACM National Trade Credit Report presents a graphical look at the percent past due over time, and calculates a real-time score.

More Features of the NACM National Trade Credit Report:

- No self-reported information

- A Business Credit Score based on forty-two variables

- Access to 12 month payment history from contributing member’s trade data

- Critical “flash” information reported by NACM members on liens, bankruptcies, collection referrals, NSF checks, etc.

- Ability to arrange direct contact with other members on specific trade line questions

- “Poll My Group” to build an instant, scored credit report with responses from your fellow industry credit group members

- Discounts offered based on volume and electronic contribution of monthly AR information

- Portfolio Management Suite

National Trade Credit Report Sample

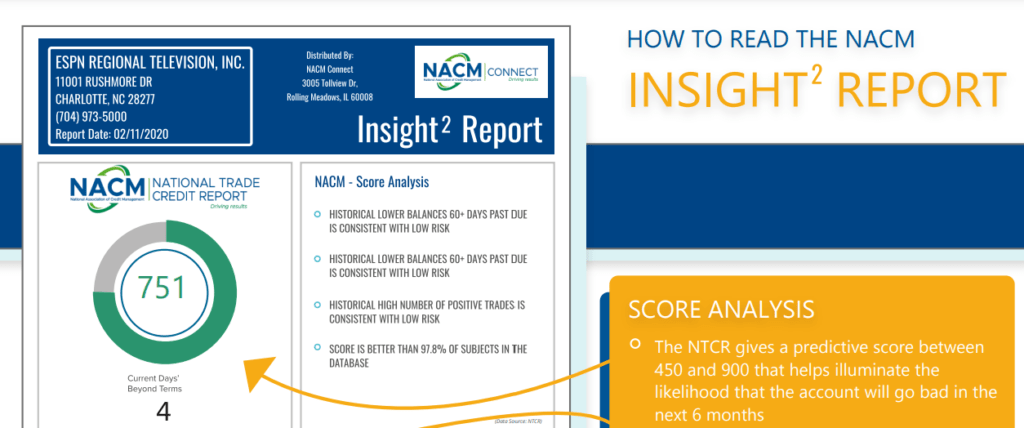

This report combines trade data from NACM and from Experian to give you a better understanding of credit risk. The report provides an NTCR predictive score on whether or not a company will go delinquent in the next 6 months and two Experian scores on the likelihood of serious delinquency or bankruptcy.

We have added the Insight purple access button near the National Trade Credit Report button on your NACMConnect.org dashboard.

Sample Report

Portfolio Risk Analysis Demo

Portfolio Risk Analysis

✓ Free monthly benchmarking & segmentation by statistical risk class

✓ Compare performance against industry credit group(s), industry overall

& entire group of NTCR participants

✓ Drill down into details and export to excel

✓ Create custom PDF presentation-worthy reports for management

✓ More effectively determine when the NTCR* should be accessed

Portfolio Management Suite

Helping our Members easily, efficiently, and effectively manage their portfolio is at the heart of what we do at NACM. We’ve assembled this suite of essential services to provide you & your team with a solid foundation to proactively manage & reduce risk, deploy your resources more appropriately, and benchmark your performance against your peers, your industry, and the participating NACM member-base overall.

• Portfolio Risk Analysis

✓ Free monthly benchmarking & segmentation by statistical risk class

✓ Compare performance against industry credit group(s), industry overall

& entire group of NTCR participants

✓ Drill down into details and export to excel

✓ Create custom PDF presentation-worthy reports for management

✓ More effectively determine when the NTCR* should be accessed

• Account Monitoring

✓ Free daily email alerts you to events meeting your criteria

✓ Access the NTCR* on the accounts that really matter to you

✓ Find out between meetings pertinent activity on mutual customers

✓ Proactively manage risk with exception reporting

• Non-Member Credit Reference

✓ Effectively “outsource” responding to incoming requests for credit references

✓ You control who has access (and who doesn’t) and to what frequency

✓ Reduce risk through consistent, historical, and factual reporting

✓ Redeploy valuable resources to more significant tasks

*Pay only when you access a NTCR – and at your agreed-upon rate.

We Will Help You Every Step Of The Way

Credit Solutions Team

Neil Cline

Northern & Western Illinois, Wisconsin, Nebraska

Jim Kelly

Indiana, Maine, South West Ohio (Cincinnati/Dayton areas), Vermont, Western Pennsylvania

Darren Greene

Massachusetts, New York, Ohio: Eastern, Northern and Central areas,

Gloria Scott

Chicago Area

Rich Steinkoenig

Connecticut, Kansas, Michigan, Missouri, New Hampshire, Rhode Island

Neil Cline

Northern & Western Illinois, Wisconsin, Nebraska

Jim Kelly

Indiana, Maine, South West Ohio (Cincinnati/Dayton areas), Vermont, Western Pennsylvania

Darren Greene

Massachusetts, New York, Ohio: Eastern, Northern and Central areas,

Gloria Scott

Chicago Area

Rich Steinkoenig

Connecticut, Kansas, Michigan, Missouri, New Hampshire, Rhode Island

Neil Cline

Northern & Western Illinois, Wisconsin, Nebraska

Jim Kelly

Indiana, Maine, South West Ohio (Cincinnati/Dayton areas), Vermont, Western Pennsylvania

Darren Greene

Massachusetts, New York, Ohio: Eastern, Northern and Central areas,

Gloria Scott

Chicago Areathat helps us to make credit decisions in a timely manner."

The return rate on my inquiries is about 99%. The success rate in accessing reports is extremely high when ordering Equifax Canadian Reports.“