Seminars

NACM Connect offers a variety of topics through educational seminars throughout the year in half-day and full-day formats. Keep up with the latest developments affecting the credit community by participating in our educational programming. If you have any questions or suggestions for seminars topics please contact Bob Rabe at bob.rabe@nacmconnect.org.

Watch this page for new seminars or register for one of our upcoming events.

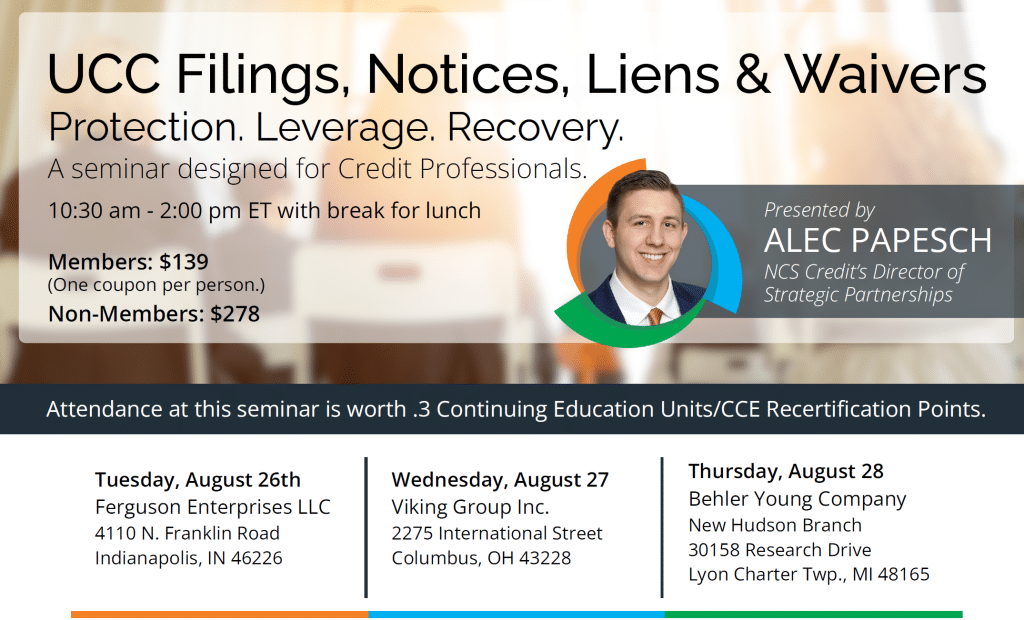

UCC Filings

10:30 am – 11:30 am ET

- Impact to DSO, Cash Flow, Working Capital

- Overview & Benefits of Secured Transactions

- Basic UCC Filings

- Purchase Money Security Interest Filings

- Chapter 7 and Chapter 11 Bankruptcies

- Types of Filing: Which is Right for You?

- Who Might Use these Tools?

- Security Agreements and Financing Statements

- Forms and Filing Rules

- Recognizing Opportunities to Take Security

- Questions and Answers

Notices, Liens & Waivers

12:00 pm – 2:00 pm ET

- Impact to DSO, Cash Flow, Working Capital

- Justifying the Credit

- A Brief History

- The Four Step Notice & Lien Process

- Types of Liens and Lien Waivers

- Construction Credit Technology

- Terms, Legal Procedures and Ladder of

- Supply

- State Laws: Similarities and Differences

- Foreclosure Considerations

- Bonds: Definitions and Types

- Questions and Answers

All registrations for NACM Connect education events are taken online at www.nacmconnect.org. While registering online, you will have the opportunity to choose your payment method. We are happy to take a credit card online or invoice you. You will also have the opportunity to apply coupons as allowed. All payments must be received one week prior to seminar date.

Cancellation Policy: Cancellations must be received in writing via email or mail, no later than one week prior to meeting date to qualify for full refund. Cancellations received later than one week prior to the meeting date DO NOT qualify for a refund of registration fees. Sorry, phone cancellations cannot be honored. If you have any questions, please email info@nacmconnect.org.

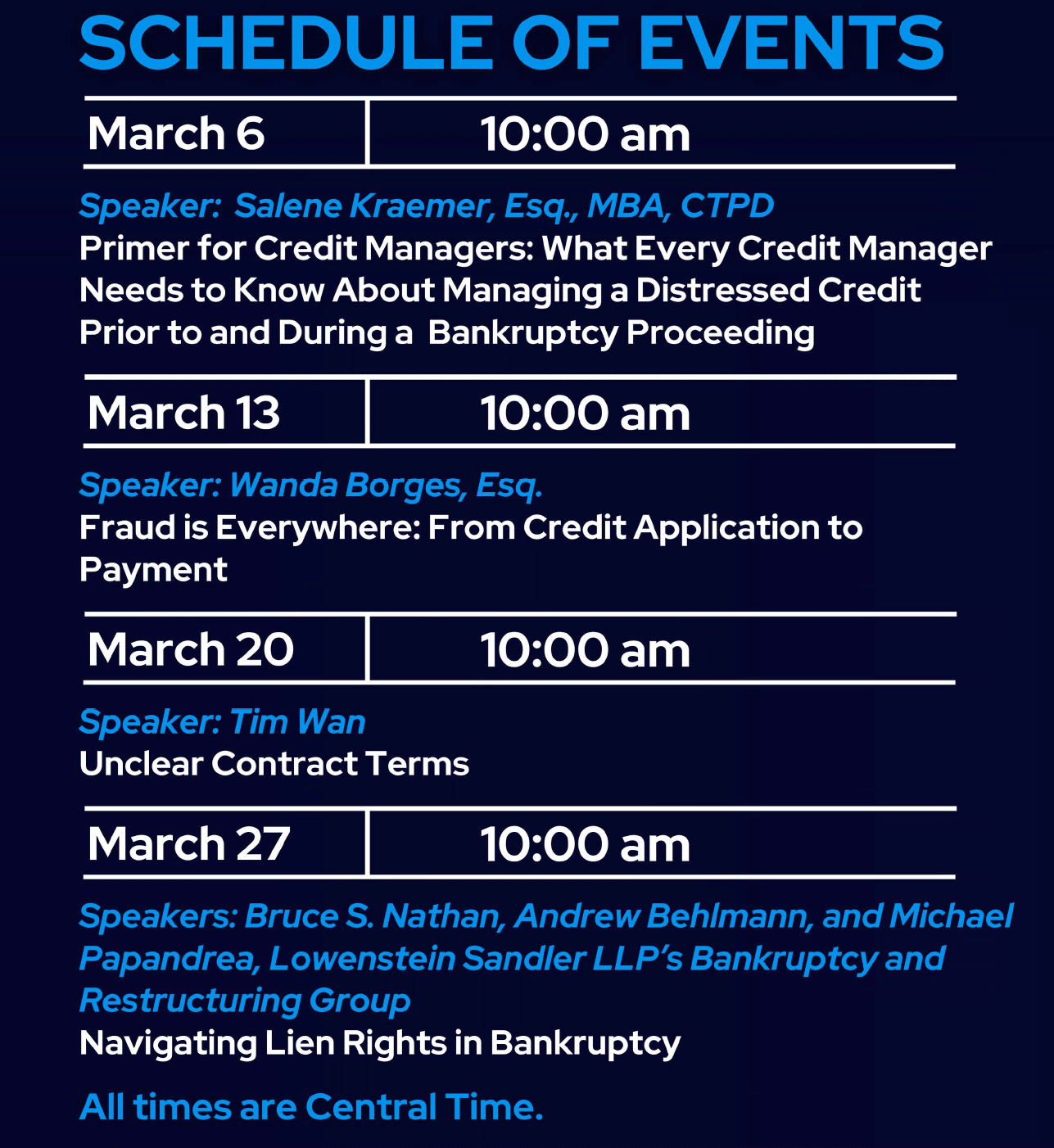

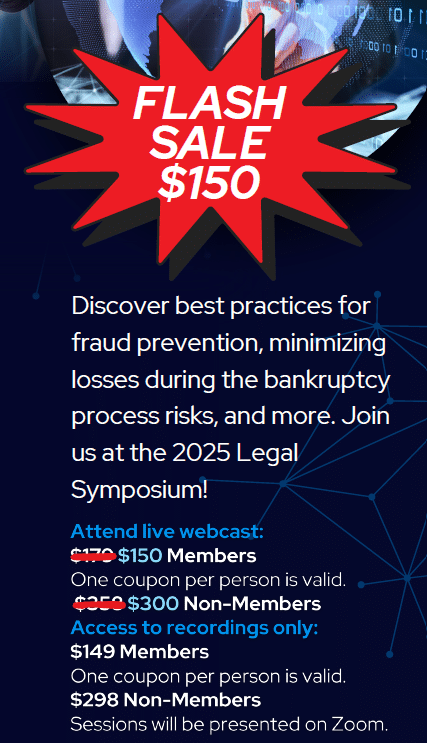

NACM Connect and the Commercial Law League of America are happy to announce the agenda for the 2025 Legal Symposium. The program will be 100% virtual this year and the sessions will be recorded, so if you can’t attend live you will still be able to access the presentations from our esteemed speakers.

March 6, 10:00 a.m.

Primer for Credit Managers: What Every Credit Manager Needs to Know About Managing a Distressed Credit Prior to and During a Bankruptcy Proceeding,

Salene Kraemer, Esq., MBA, CTPD

Delve into the intricate dynamics of managing credit risk when a customer faces financial distress. We will explore proactive measures that can be implemented prior to a bankruptcy filing, as well as best practices for maintaining relationships and minimizing losses during the bankruptcy process.

In this session, we will cover:

- Bankruptcy and non-bankruptcy options for distressed businesses.

- Basics of a Chapter 11 proceeding from both the creditor and debtor perspective.

- How to protect a claim prior to a bankruptcy

- How to protect a claim during a bankruptcy

- Issues that can arise during a case

- Discuss collection strategies

Bio:

Salene Mazur Kraemer is the founding principal and managing partner of MAZURKRAEMER BUSINESS LAW, www.mazurkraemer.com, an entrepreneurial business law and consulting firm. Salene leads a team of lawyers who serve as your outside, in-house counsel, offering attentive services, without compromising technical skill or experience. With offices in New York, NY, Weirton, West Virginia, and Pittsburgh, PA, MAZURKRAEMER counsels middle market to public companies at every stage of the business cycle in a broad range of business transactions, particularly reorganization, real estate, collection, creditors’ rights, and general business litigation.

With 25 years of experience, Salene concentrates her personal practice on Chapter 11 commercial bankruptcy law, along with general business transaction work. She has represented businesses and individuals in multi-million matters in courts all over the country.

Salene earned her B.A. as a University Honors Scholar, and Masters in Business Administration, from West Virginia University, both magna cum laude. She earned her J.D. from Villanova University School of Law. Salene is Board-Certified in Business Bankruptcy by the American Board of Certification. She serves on the Executive Committee and is the Marketing Committee Chair for the American Board of Certification. She also serves as co-chair of the Marketing and Membership Committee for the American Bar Association’s Business Bankruptcy Committee. An active business blogger and former turnaround management consultant, she earned a Certified Turnaround Analyst designation from the Turnaround Management Association. See blog: www.mazurkraemer.wordpress.com and www.steelvalleybankruptcy.wordpress.com . She has been named to the PA Super Lawyers list for several years and was named to the Top 500 U.S. Leading Restructuring Attorneys by LawDragon in 2022 and 2023.

March 13, 10:00 a.m.

Fraud Is Everywhere: From Credit Application to Payment

Wanda Borges, Esq.

Fraud impacts the commercial trade credit industry, from the initial credit application to payment. Beginning with the legal definition of fraud, this program has been prepared to equip the credit professional with the knowledge to detect, prevent, and address fraud in the commercial trade credit industry. Beginning with the legal definition of fraud, the presentation will include the following points:

- Types of Fraud

- Key Indicators of Detect Fraud

- Red Flags in Credit Applications and other Documentation

- Best Practices for Fraud Prevention

- Some Case Studies will be Presented

Bio:

Wanda Borges, Esq. is the principal member of Borges & Associates, LLC, a law firm based in Syosset, New York. For more than forty years, Ms. Borges has concentrated her practice on commercial litigation and creditors’ rights in bankruptcy matters, representing corporate clients and creditors’ committees throughout the United States in Chapter 11 proceedings, out-of-court settlements, commercial transactions, and preference litigation. She is a member and Past President of the Commercial Law League of America and has been an Attorney Member of its National Board of Governors, a Chair of the Bankruptcy Section, and Creditors’ Rights Section. She is an internationally recognized lecturer and author on various legal topics including Bankruptcy Issues such as 503(b)(9) claims and preferences, the Uniform Commercial Code, ECOA, FCRA, antitrust law, and current legal issues such as Credit Card Surcharge issues, Social Media, Cybersecurity and Ethics for the Trade Credit Grantor and current proposed legislation that may impact trade credit grantors. Ms. Borges has authored, edited, and continues to contribute to numerous publications.

March 20, 10:00 a.m.

Unclear Contract Terms

Tim Wan

It’s time for everyone’s favorite game show: Unclear Contract Terms! So many cases are litigated and so many disputes happen, not because of someone’s failure to perform, but because the parties never had a meeting of the minds. We will discuss various terms that are used in business and have been used in business transactions, which are debatable, arguable vague, and unclear, and we will cover what more precise language can be used. Think about terms like “ASAP” or “Bi-Monthly”.

Bio:

Timothy Wan, Esq. is a Senior Partner and the Chief Executive Officer (CEO) of Smith Carroad Wan & Parikh, a division of the Wan Law Group, located on Long Island, New York. Mr. Wan’s areas of expertise include managing the creditor’s rights and collection law practice, serving as General Counsel to various small businesses in the local business community, and spearheading practice in the area of entertainment law, music law, copyright, and intellectual property.

Mr. Wan was admitted to the New York State Bar in January 2001, after graduating from Brooklyn Law School with his Juris Doctor where he was a member of the Moot Court Honor Society, and from Vassar College with a double B.A. in Political Science and Theatre in 1997.

Mr. Wan is a Past Chair of the Eastern Region of the Commercial Law League of America, a Past Chair of the CLLA Young Member’s Section, a past member of the Board of Governors, and served as the first-ever two-consecutive-term President from 2019-2021. He also serves as the President of the New York State Creditors Bar Association. Mr. Wan is a two-time Past President of the Infinite Exchange Chapter of BNI, and his firm is a member of the International Association of Commercial Collectors. Mr. Wan is a published author of the New York chapter of the textbook, “Judgment Enforcement” published by Aspen Publishing, and is a featured columnist and on the Board of Associate Editors for “Commercial Law World”. He is also the attorney advisor to the Commack High School Mock Trial team, and regularly lectures on topics regarding creditor’s rights, collection law, business change management, improving business efficiency, and legal strategy.

March 27, 10:00 a.m.

Navigating Lien Rights In Bankruptcy

Bruce S. Nathan, Andrew Behlmann, and Michael Papandrea, Lowenstein Sandler LLP’s Bankruptcy and Restructuring Group

Most states have enacted laws creating materialmen’s and mechanics’ liens in favor of suppliers of goods and services for construction projects. This program focuses on a creditor’s ability to obtain, preserve, and enforce its lien rights when a customer in the construction supply chain files for bankruptcy. The speakers will discuss:

- Differences among state laws governing the creation, perfection, maintenance, and enforcement of lien rights;

- The impact of a bankruptcy filing, including the automatic stay, on lien rights and related remedies;

- Strategies to protect lien rights, including how inaction risks the loss of lien rights in connection with Chapter 11 DIP financing, a bankruptcy sale, and a Chapter 11 plan

- Special defenses that a lien creditor can assert when confronted with a preference claim.

Bios:

Bruce S. Nathan is currently a partner in the Bankruptcy, Financial Reorganization, and Creditors’ Rights Department of the law firm of Lowenstein Sandler PC. Mr. Nathan concentrates on all aspects of creditors’ rights and workouts in bankruptcy, out-of-court matters, and other types of insolvency matters and in developing and documenting various types of credit enhancement arrangements. Mr. Nathan holds combined J.D./M.B.A. degrees from the University of Pennsylvania Law School and the Wharton School of Management. He is also an active member of the American Bankruptcy Institute (“ABI”) and its Unsecured Trade Creditor Committee, is a contributing editor of ABI Journal’s “Last In Line Column”, and ABI’s “Second Circuit Cases Update”, and is the author of ABI’s Manual On Trade Creditors’ Rights of Reclamation And Stoppage of Delivery of Goods. Mr. Nathan is also an active member of, and a regular lecturer for, the National Association of Credit Management (“NACM”), is a member of NACM’s Editorial Advisory Board, is a frequent contributor to NACM’s Business Credit, and is a contributing editor of NACM’s Manual of Credit and Commercial Laws.

Andrew Behlmann leverages his background in corporate finance and management to approach restructuring problems, both in and out of court, from a practical, results-oriented perspective. With a focus on building consensus among multiple parties that have competing priorities, Andrew is equally at home both in and out of the courtroom and has a track record of turning financial distress into positive business outcomes. Clients value his counsel in complex Chapter 11 cases, where he represents debtors, creditors’ committees, purchasers, and investors. Andrew writes and speaks frequently about bankruptcy matters and financial issues. Before becoming a lawyer, he worked in senior financial management at a midsized, privately held company.

Michael Papandrea provides counsel to debtors, creditors’ committees, individual creditors, liquidating trustees, and other interested parties with respect to corporate bankruptcy and creditors’ rights matters, including bankruptcy-related litigation. Mike enjoys keeping clients and relevant industry professionals in the loop regarding bankruptcy, insolvency, and creditor’s rights issues, regularly writing articles for and speaking to professionals in the credit and risk management space. Mike also takes pride in his commitment to the community and provides pro bono representation to individuals and nonprofit organizations regarding bankruptcy and foreclosure-related matters.

Prior to joining the firm, Mike held multiple clerkships in the U.S. Bankruptcy Court; he clerked for the Hon. Jerrold N. Poslusny, Jr. (District of New Jersey), the Hon. Ashely M. Chan (Eastern District of Pennsylvania), and the Hon. Gloria M. Burns (Chief Judge, District of New Jersey). Mike applies the valuable insights learned from working closely and directly with these members of the judiciary to his everyday practice.